Finding Your Path

Hitting The Peak of Apartment Deliveries

By Lorne Polger, Senior Managing Director

Deliveries of apartments peaked in 2024, with over 585,000 new units delivered – the highest amount since the 1970s. This surge was driven by low interest rates, strong rental demand associated with a corresponding housing shortage, and a post-pandemic construction boom. Sunbelt cities including Austin, Dallas and Phoenix led this growth.

The tail end of this construction boom has also seen a significant decline in new apartment starts. In 2024, multifamily developers started 254,100 fewer units than they completed, resulting in the second-largest deficit on record. The die is cast for a plunge in new apartment supply by 2026 and beyond.

There are Substantial Regional Variations in New Deliveries

While the national data points to a slowdown, regional disparities persist. Houston reached its supply peak in 2024, and Dallas, Austin, and Phoenix are peaking this year. Conversely, San Francisco, Baltimore, and Boston, which experienced more modest supply growth, are now seeing solid rent growth.

According to RentCafe, an online marketplace for property owners and tenants, despite the influx of new units, demand for apartments continues to outstrip supply, driven by significant growth in the number of renters.

Pathfinder Markets

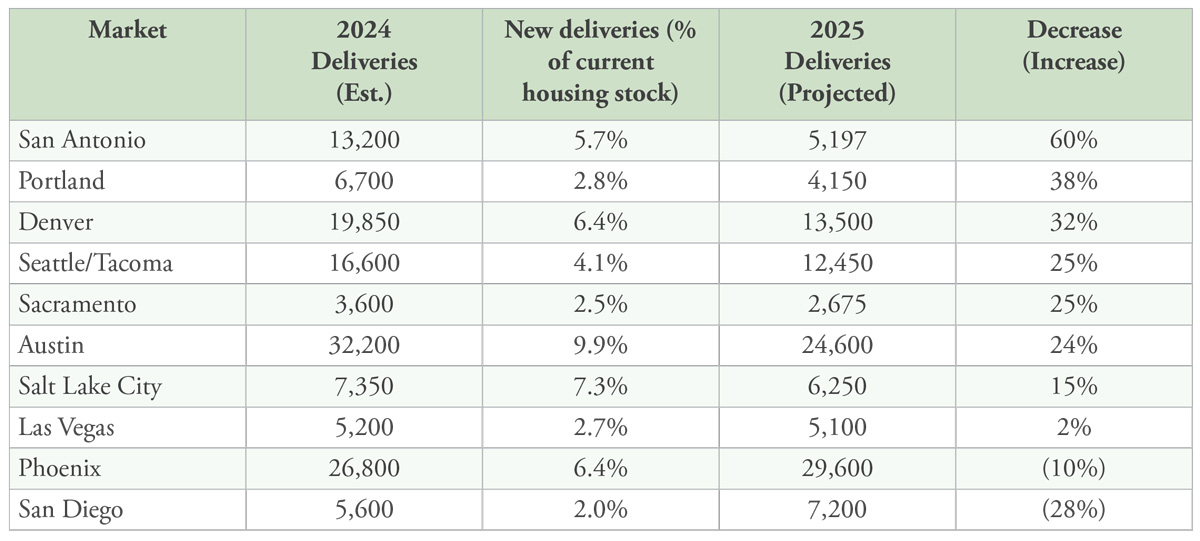

According to national multifamily brokerage firm Berkadia and research provider CoStar, current and prospective Pathfinder markets are seeing big drops in deliveries.

A Coming Shortage and Rent Growth Ahead

While the construction boom put a dent in housing shortages in certain markets, the significant decline ahead in new project starts signals that supply may not keep pace with demand in 2026-2028. If we’re reading the tea leaves correctly, expect to see increased competition for available units and upward pressure on rents, particularly in higher demand areas. We think the apartment market is transitioning from a period of rapid expansion to a period of stabilization, tighter supply and rent growth.

How significant is the upcoming decline? Very. National apartment brokerage firm Berkadia forecasts a marked slowdown in new deliveries in eight of the ten Pathfinder current/potential markets in 2025.

The decline in new apartment deliveries should continue for several years. According to the National Association of Home Builders, deliveries may fall to around 332,000 units in 2026, reflecting the impact of reduced construction starts in preceding years. This represents about a 40% reduction from 2024, the peak delivery period. And for 2027, projections indicate delivery of around 320,000 units, a 10-year low.

Why the huge reduction in new development? A multitude of factors are at play. We’ve seen significant increases in construction costs (both labor and materials, and that’s before any potential tariff impacts), insurance, land and borrowing costs. In addition, traditional construction lenders – like regional banks – have reduced their available leverage, requiring more equity in each deal. They’re also much pickier about who and what they are lending on. For some lenders, multifamily is temporarily no longer in the “most favored nation” class for new development loans.

Meanwhile, the temporary oversupply in certain submarkets has resulted in rent concessions, and stagnant rent growth, crimping revenues. For example, in Austin, the vacancy rate has ballooned to over 15%, with some new projects offering a 3-month free rent concession on a 12-month lease. It’s very difficult to pencil a new deal since the returns aren’t there.

So, what’s in the cards for the next few years? A tale of two cities. Markets that continue to show positive demographics (population, job and rent growth) and economic drivers will absorb that temporary oversupply over the next 12-24 months. In those markets, we expect a slingshot type recovery, with significant rent growth ahead as the new supply tails off. That may cause developers to return to those markets with new projects, but those projects will be conceived in 2027-2028 and delivered only in 2029-2030. That’s a long way off, and there’s a lot of rent growth that’s likely from now to then. Markets with weaker demographics and economic drivers will plod along without significant rent growth. At Pathfinder, we’re focused on strong markets and are bullish for the positive momentum ahead.

Lorne Polger is Senior Managing Director of Pathfinder Partners. Prior to co-founding Pathfinder in 2006, Lorne was a partner with a leading San Diego law firm, where he headed the Real Estate, Land Use and Environmental Law group. He can be reached at lpolger@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER MULTIFAMILY OPPORTUNITY FUND IX, L.P.

CHARTING THE COURSE

How the AI Tsunami Will Reshape Our World in Short Order

FINDING YOUR PATH

Hitting The Peak of Apartment Deliveries

GUEST FEATURE

Grading Interest Rate Predictions

ZEITGEIST

News Highlights

TRAILBLAZING

Sundance Apartments, Milton (Seattle), WA

NOTABLES AND QUOTABLES

Innovation