Intelligent, Innovative InvestingTM

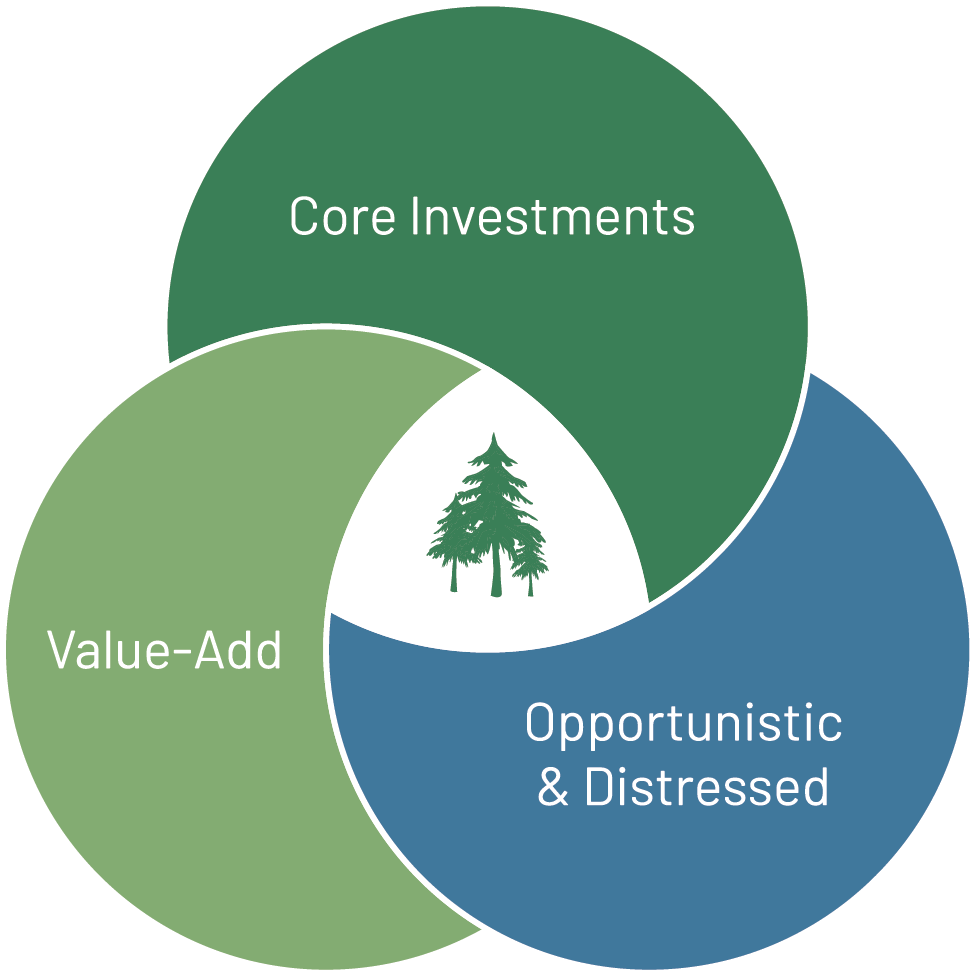

Pathfinder takes both a top-down (macro-economic) view and a bottoms-up (fundamental, property-level) approach to underwriting each and every investment. Pathfinder’s deep relationships offer us access to unique investment opportunities. Our innovative approach to managing the properties creates opportunities for superior returns. We seek to create value through investments that are:

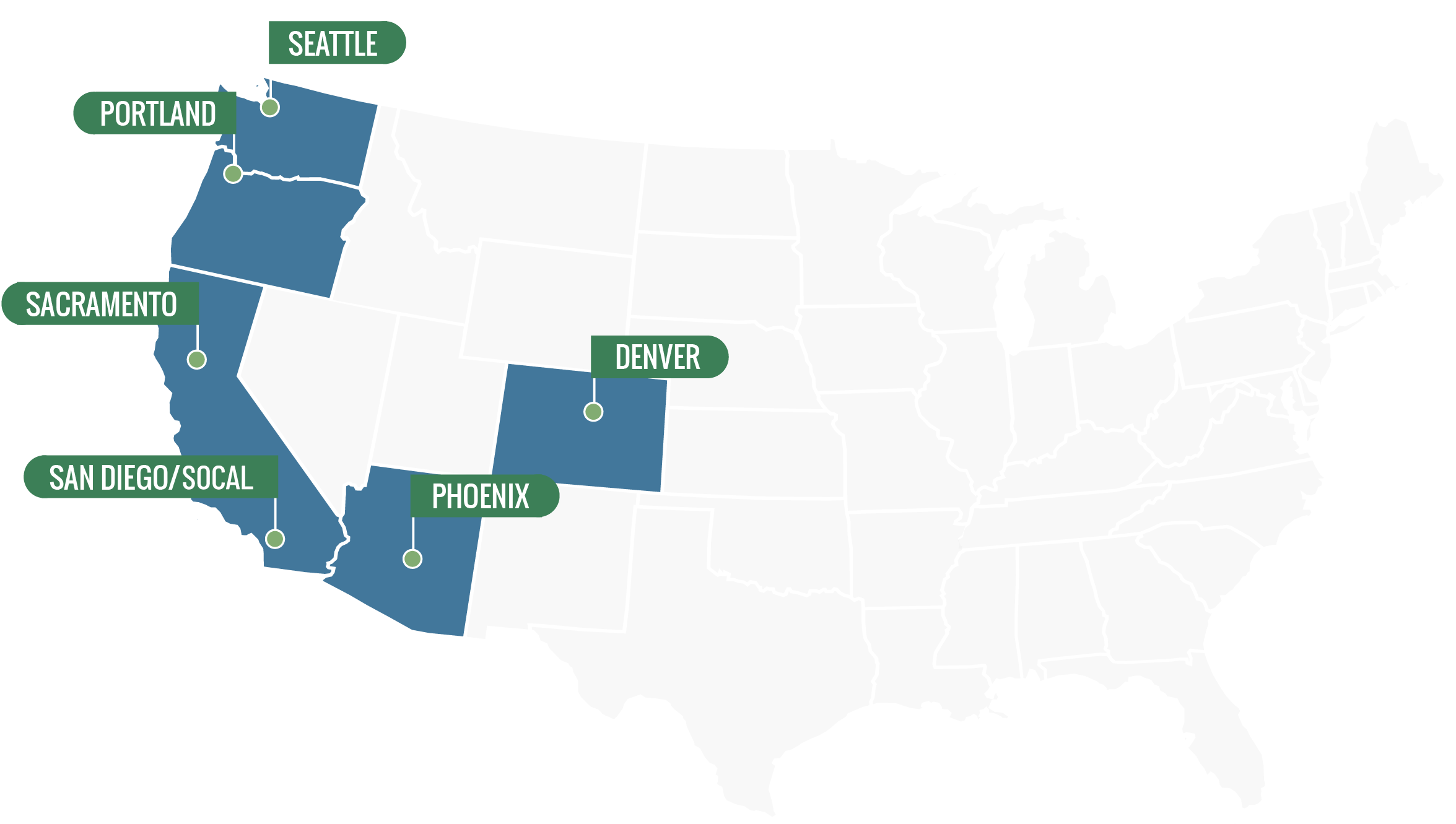

Pathfinder Target Markets

Our investment strategy involves not only choosing the right properties, but choosing target markets that are economically resilient. Our six primary markets benefit from jobs in resilient sectors, like technology, finance and government and have lower concentration of jobs in vulnerable industries, like tourism, capital goods manufacturing and energy/natural resources. See our Pathfinder Economic Resiliency IndexTM (PERITM) to learn more.

Why We Like Apartments

Multifamily is Highly Resilient

Relative to other real estate sectors like hospitality, retail and office, multifamily maintains high occupancies and experiences strong rent collections even in turbulent times

Portfolio Financed with Fixed-Rate Debt at About Half of Current Rates

Weighted average, fixed rate debt on portfolio at a blended interest rate of just 3.4%

Declining Homeownership

The homeownership rate has declined from 69% to 66% over the past decade, causing millions of former homeowners to rent

Favorable Demographics

The 73 million Millennials, a generation now larger than the Baby Boomers, are delaying marriage and family formation and value mobility, driving them to rent much longer than previous generations

Our Current Fund

Pathfinder Partners Income Fund, L.P. ("Income Fund")

With an emphasis on downside protection, the Pathfinder Income Fund focuses on stabilized, income-producing, Class-B apartments, providing a margin of safety not found elsewhere. The Fund’s conservative approach to leverage, bias toward fixed-rate debt and emphasis on cash-flowing properties provide investors with an income-producing, tax friendly opportunity to widen their exposure to real estate.

Subscribe to the Pathfinder Report

Read our engaging editorial content about real estate trends, investments & the economy.

© 2025 Pathfinder Partners. All Rights Reserved.