Guest Feature

Insights from the Corner Office: A Conversation with Mitch Siegler, Pathfinder’s Co-Founder

By Matt Quinn, Managing Director

I started working with Mitch Siegler at Pathfinder Partners in 2009, a few years after he co-founded the company with Lorne Polger. I was 26 years old – under-experienced and over-confident – and Mitch quickly became one of my first mentors. Among many lessons, he taught me the lasting value of humility, integrity and respect.

There’s a level of sophistication and intensity to Mitch that has helped Pathfinder raise hundreds of millions of dollars, deliver consistent returns to our investors and grow into one of San Diego’s most respected apartment investment firms. Earlier this month, I sat down with Mitch to talk about his past, the current real-estate market and his vision of the future.

Q: Tell us about your early years and your family background.

Mitch: I grew up in Kansas City, Missouri, in what was then a brand-new suburban neighborhood where kids could roam free, play baseball and ride bikes until dinner. My dad was a lawyer, my mom a homemaker. My dad’s story had a huge impact on me.

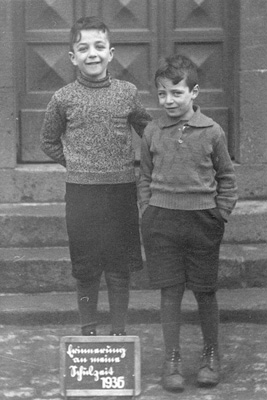

My dad immigrated to the United States as a 12-year-old after his family fled Nazi Germany in 1937. They ultimately settled in Omaha, Nebraska, where my grandfather was a cattle trader. At 17, he enlisted in the U.S. Army during World War II – so young he had to get a judge’s permission. After the war, he attended college on the G.I. Bill (he was the first in his family to attend college), served in Korea and built a traditional American life. His courage and discipline shaped much of how I think about opportunity, gratitude and perseverance.

Q: There’s a rumor you started reading the Wall Street Journal at age 10. Confirm or deny?

Mitch: Pretty close. My dad brought it home every evening and I started reading it when I was about 14 – mostly the headlines and stock tables at first. I’ve subscribed since college. I was always entrepreneurial: earned money mowing lawns, shoveling snow, washing windows, delivering advertising flyers – even, running a small roofing and siding company through college. In college, my roommate and I bought and sold scrap gold and silver when prices spiked in the early ’80s. I always had something going on.

Q: What were some of your early career experiences before Pathfinder?

Mitch: After college, I joined Anheuser-Busch’s management-training program – a tough job to land during the 1982 recession. Everyone else had engineering degrees or MBAs and I was the lone finance undergrad. It was a great foundation. A few years later, I earned my MBA while working for A-B in Los Angeles.

I moved to San Diego in 1987 to join Sorrento Ventures, a venture-capital firm backed by some of the city’s top business and technology leaders to fund homegrown companies. Back then, San Diego was just beginning its long tech and life sciences boom. That experience exposed me to incredible entrepreneurs – people who were raising capital, building businesses and creating things from scratch. It reinforced that I wanted to do something entrepreneurial myself.

Q: How did Pathfinder Partners come about?

Mitch: After launching and growing several companies, including an import-export business in the former Soviet Union in the 1990s, I was talking with my friend, Lorne Polger, whom I’d known for 20 years. Lorne was a leading real-estate attorney; I had a finance background and had built businesses – our skill sets were complementary.

We founded Pathfinder in 2006, a bit before the Great Recession hit. We saw cracks forming in the housing, mortgage and capital markets and believed banks would soon become major owners of foreclosed real estate. When that happened, we were ready. We began buying distressed loans, taking ownership of the underlying properties and stabilizing them.

Over time, we noticed that our multifamily investments consistently outperformed our other real estate asset classes. Apartments were simpler, less volatile and closely tied to population and job growth. So, as we sold off our non-apartment assets and narrowed our focus to acquiring value-add apartments in a handful of Western U.S. markets where we had deep relationships. That specialization became the foundation of Pathfinder’s success.

Over time, we noticed that our multifamily investments consistently outperformed our other real estate asset classes. Apartments were simpler, less volatile and closely tied to population and job growth. So, as we sold off our non-apartment assets and narrowed our focus to acquiring value-add apartments in a handful of Western U.S. markets where we had deep relationships. That specialization became the foundation of Pathfinder’s success.

Q: You’re famous around the office for your “Mitchisms” – those obscure but insightful quotes you use to frame current situations. What are some of your favorites?

Mitch: (Laughs) I’ve collected a few over the years.

- “You’ve got to know which way the wind is blowing.” Markets are always shifting – you need to sense direction early.

- “Zig when others zag.” Don’t follow the herd, do things that are contrarian in nature.

- “Buy your straw hats in the winter.” Look for value when others aren’t paying attention.

- “Price is what you pay; value is what you get.” That one’s straight from Warren Buffett.

- And one of my favorites: “Never invest in a company with a fountain in the lobby or a CEO on the cover of Business Week.” The first demonstrates a lack of fiscal prudence. By the time the second one happens, it’s usually too late.

- Another lesson: “You never find just one cockroach” – problems tend to come in clusters. We try to utilize that mindset in our investing.

Q: What’s your view of today’s apartment market?

Mitch: We’re in one of the more compelling apartment acquisition windows I’ve seen – certainly among the top three of my career. Many owners who bought properties in 2021 or 2022 with short-term floating-rate loans can’t refinance and that’s creating forced sellers.

For buyers like us who can secure fixed-rate debt, add value through renovations and hold properties longer-term, this is a “meat-and-potatoes” environment. In our current fund – Pathfinder Multifamily Opportunity Fund IX – we’re buying below replacement cost at roughly 75 cents on the dollar from peak 2022 pricing. We’re adding tremendous value through renovations and better management, and we see a supply-demand imbalance building in the next several years, which means we’ll likely see rent growth. If we see cap-rate compression as interest rates fall, that’s gravy on top. But even without it, we’re buying with a margin of safety, which is how you survive and thrive in this business.

Q: What do you see as the biggest risks today?

Mitch: The biggest dangers are usually the ones you don’t anticipate. In real estate, that might mean sudden regulatory changes – new rent-control rules, fee limits or tenant laws that disrupt a business plan. We work to hedge these challenges through portfolio diversification – our funds own apartments in red, blue and purple states – and through our deep experience successfully navigating jurisdictions that may have more onerous landlord regulations.

Another danger is over-leveraging or taking on debt that doesn’t align with the property’s business plan. At Pathfinder, we mitigate that by firewalling every property in its own special-purpose entity, using primarily fixed-rate loans, not cross-collateralizing assets and using lower overall levels of debt. For us, it’s all about structuring downside protection. We like to hit singles and doubles, not swing for the fences, and that philosophy has served us well through multiple cycles.

Q: Looking ahead, what trends will shape real estate investing over the next decade?

Mitch: We try to look around the bend and see things that aren’t readily apparent to everyone. That’s how we differentiate ourselves and spot opportunities. That’s more challenging in an environment where information has become more democratized. You can now underwrite a property from your desk with 360-degree imagery and vast data sets. That levels the playing field, so competitive advantage comes from insight more than access.

Technology and AI will continue to reshape every part of the business including underwriting, marketing, leasing and resident services. We’re already seeing it. Understanding and employing those tools effectively will be critical for investors and operators alike.

Q: Finally, share a few guiding principles with the next generation of investors and leaders?

Mitch: Here are three things to consider:

- Act with integrity. Always do the right thing, even when it’s hard. It takes a lifetime to build a good reputation and a moment to destroy it.

- Treat others with respect. Whether it’s investors, brokers, staff, or sellers, take the long-term view. Many of our best relationships – and repeat sellers – come from dealing fairly and honorably.

- Give back. Be active in your community. Mentor young people. Support nonprofits with your time and your treasure. There’s no direct quid pro quo but it speaks volumes about who you are.

Those values have served me well and at Pathfinder, they guide how we do business. I think they’ll continue to matter even more in the years ahead.

Matt Quinn is Managing Director at Pathfinder Partners, focusing on asset management activities. Prior to joining Pathfinder in 2009, Matt worked with a San Diego-based firm which consulted on mergers and acquisitions and with the Wealth Management division of a California regional bank. He can be reached at mquinn@pathfinderfunds.com

Share this Article

IN THIS ISSUE

PATHFINDER MULTIFAMILY OPPORTUNITY FUND IX, L.P. AND UPCOMING WEBINARS

CHARTING THE COURSE

Investment Implications of Government Shutdowns and Budget Deficits

FINDING YOUR PATH

The Fed, The Fed, The Fed

ANNOUNCING THE CLOSING OF THE FLETCHER

GUEST FEATURE

Insights from the Corner Office: A Conversation with Mitch Siegler, Pathfinder’s Co-Founder

ZEITGEIST

News Highlights

TRAILBLAZING

Creating Peace of Mind

NOTABLES AND QUOTABLES

Foresight