Guest Feature

Grading Interest Rate Predictions

By Scot Eisendrath, Managing Director

Making accurate predictions is a tough business, especially when forecasting the economy – or the future! Looking back, there have been some very good financial forecasts, and some equally bad ones.

Making accurate predictions is a tough business, especially when forecasting the economy – or the future! Looking back, there have been some very good financial forecasts, and some equally bad ones.

In the late 1990’s Robert Shiller famously called the dot-com bubble, warning of inflated technology stock prices in his book Irrational Exuberance. Of course, the bubble burst in 2000, leading to trillions of dollars in lost market value from the stock market crash that followed. Another famous prediction came in 2006 when Nouriel Roubini (aka Dr. Doom) forecast the Global Financial Crisis (GFC), widely known as the Great Recession, warning of a housing bubble that would result in widespread mortgage defaults and a worldwide banking crisis. Cracks began showing up in 2006, the year Pathfinder started, and the GFC began in 2007 as the U.S. housing market collapsed, driven by the issuance of low-quality mortgage-backed securities. The economy did not bottom out from the impact of the GFC until late 2009, but the effects are still being felt today. Shiller was correct again (that guy is good!) when he warned of a housing market bubble in 2005. Not only did he call the dot-com bubble in 2000, but also the Great Recession in 2007.

There have also been some poor economic predictions. Many smart people did not see the Great Depression coming – renowned economist John Maynard Keynes famously said in 1928, just a year before its onset, that “we will not have any more crashes in our time”, and Irving Fisher, another prominent economist of the early 1900’s, stated just days prior to the stock market crash in October 1929 that “stock prices have reached what looks like a permanently high plateau”. Ben Bernanke, then chairperson of the Federal Reserve Bank, said in 2007 that the “subprime mortgage crisis is contained”; we all know how that played out.

There have also been some poor economic predictions. Many smart people did not see the Great Depression coming – renowned economist John Maynard Keynes famously said in 1928, just a year before its onset, that “we will not have any more crashes in our time”, and Irving Fisher, another prominent economist of the early 1900’s, stated just days prior to the stock market crash in October 1929 that “stock prices have reached what looks like a permanently high plateau”. Ben Bernanke, then chairperson of the Federal Reserve Bank, said in 2007 that the “subprime mortgage crisis is contained”; we all know how that played out.

Now you would think that calling the general direction of the movement in interest rates would not be as difficult as calling a market bubble, whether in the stock market, housing market or tulip market. I started to think about interest rates, and consensus opinions over the past couple of years on their future direction. I am starting to believe that when most people believe interest rates are going up, they go down, and vice versa. It made me wonder about sources that track interest rates and how past predictions have fared. It brought me to forward interest rate curves and the Hairy Chart.

The forward curve for interest rates is a projection that graphically represents expected future interest rates over time. It is derived from various forms of market data, including forward or futures contracts. The forward curve provides investment market participants (in real estate, the participants are borrowers, investors and lenders) insights into projected price and interest rate movements, and they also help to determine the loan terms lenders are willing to offer and the pricing of associated financial instruments, such as interest rate caps and swaps. As an example, a real estate borrower taking out a variable rate mortgage may use the forward curve to project out the interest rates over the term of the loan to estimate the interest expense they will need to pay. That borrower may also buy an interest rate cap to mitigate risk (Pathfinder does this), which caps the maximum interest rate a borrower pays over a period for the loan. The cost of the interest rate cap is determined by the forward rate curve, among other variables (including timing, expected volatility, etc.).

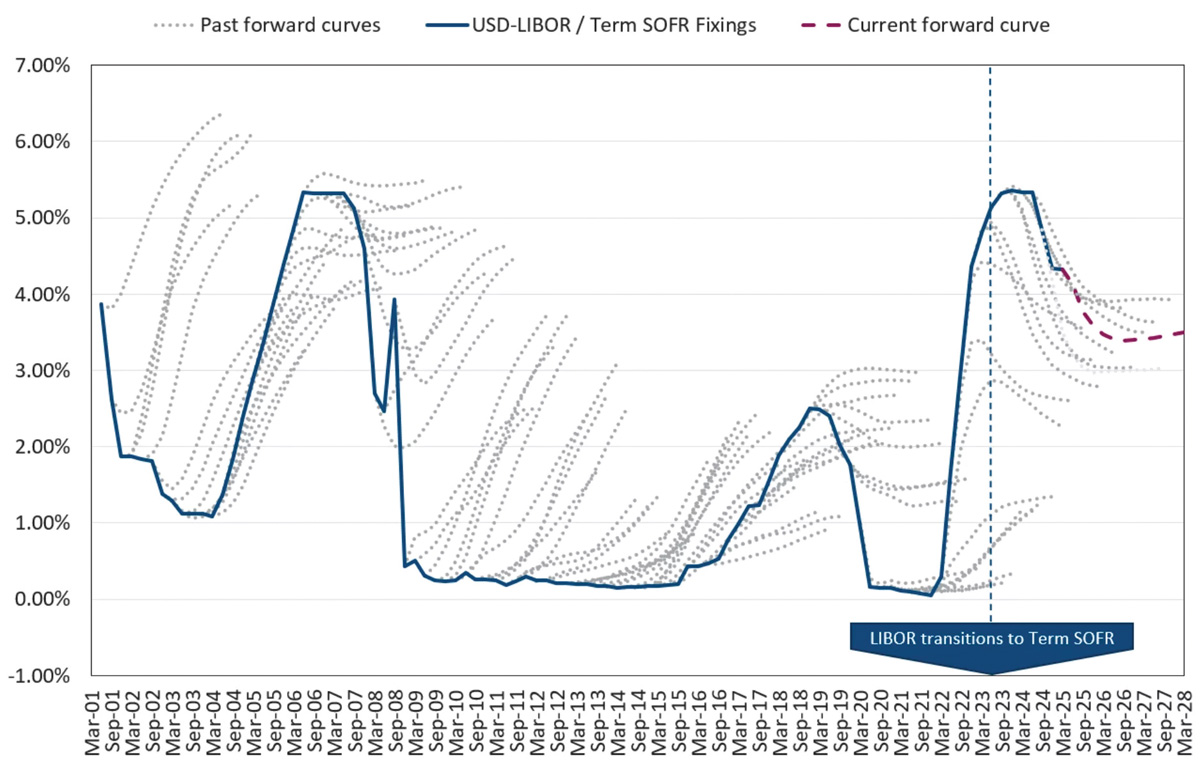

1-Month USD LIBOR / Term SOFR vs. Historical Forward Curves

The Hairy Chart, developed by Chatham Financial, a global financial risk management firm, can be thought of as a report card for historical forward rate curves, grading them based on their accuracy. The graph plots past forward rate curves against actual movements to graphically show how the past predictions fared. It is called the Hairy Chart because the past forward curves are determined by incorporating a range of market instruments, using various data points, so its lines look “hairy” with each hair representing a different forecast at a given point in time. The Hairy Chart shows that the market has been fairly accurate predicting near-term interest rates over a period of six months or so, but beyond that, it’s not as accurate. The reasoning for accuracy declining over time makes a lot of sense – the further out into the future we are trying to make market projections the less reliable we are at predicting events, especially large, unanticipated events, such as a stock market bubble or a global pandemic – which can have dramatic effects on financial markets.

The chart above is the Hairy Chart for one month LIBOR (London Inter-Bank Overnight Rate –in June 2023 the phasing out of LIBOR to another index, SOFR occurred, so the chart incorporates both LIBOR and SOFR). One month LIBOR is a key short-term interest rate and typically moves in tandem with the Fed Funds Rate. If we take the late 2019 and early 2020 period as an example, you can see that the majority of the forward rate curves were projecting that rates would stay between 2.00% and 3.00%, but because of the Covid pandemic, we saw rates fall to zero, as the Federal Reserve made dramatic cuts to the Fed Funds Rate to keep the economy on solid footing. Then again, in late 2021 and early 2022 most of the forward rate curves were projecting that rates would gradually rise, but what happened was that rates jumped quickly as the Federal Reserve began increasing rates to fight off inflation.

Lessons learned? Well, predictions are a good starting point. Sometimes they are spot on, sometimes they are off. We need to plan and prepare for many outcomes, both in life and in business, and be prepared to be flexible and shift gears to meet the circumstances.

Scot Eisendrath is Managing Director of Pathfinder Partners. He is actively involved with the firm’s financial analysis and underwriting and has spent more than 20 years in the commercial real estate industry with leading firms. He can be reached at seisendrath@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER MULTIFAMILY OPPORTUNITY FUND IX, L.P.

CHARTING THE COURSE

How the AI Tsunami Will Reshape Our World in Short Order

FINDING YOUR PATH

Hitting The Peak of Apartment Deliveries

GUEST FEATURE

Grading Interest Rate Predictions

ZEITGEIST

News Highlights

TRAILBLAZING

Sundance Apartments, Milton (Seattle), WA

NOTABLES AND QUOTABLES

Innovation