Guest Feature

Resiliency: An Important Driver of Value for Businesses and Investors

By Brent Stuhley, Acquisitions Director

Astute investors and business leaders have sufficient humility to not confuse a bull market with their own intelligence. It’s easier to achieve success when you have strong tailwinds. The challenge is how to survive and thrive in the face of a down market or other headwinds.

Resilience for investors and businesses is the ability to anticipate, prepare for, and adapt to adverse events to keep operating. It is a concept like contingency planning and can include preparing for disruptive events such as natural disasters, cyber-attacks, pandemics, and financial crises. With the events of the past few years, we know all too well the importance of being prepared for anything. The ability to identify potential financial, operational, and organizational risks, put plans in place to mitigate them, and be able to adapt if an event does occur are critical to developing long-term resilience. Our PERITM (Pathfinder Economic Resiliency Index) was borne out of the need to understand and mitigate potential economic risks and challenges in our investment markets at the onset of the global pandemic. In February 2020, the unemployment rate was 3.5%. By April, following nationwide closures, the unemployment rate had more than tripled to 14.7%. The pandemic created significant economic disruptions, prompting the National Bureau of Economic Research to declare a recession in March 2020.

Offices in core urban locations emptied as employees worked-from-home. The retail and hospitality sectors took major hits from capacity restrictions, stay-at-home orders, and temporary closures. The travel, leisure and oil/gas industries saw revenue fall off a cliff as a huge segment of the U.S. population stayed at home to reduce the chance of contracting the coronavirus. Large manufacturers, like those in the auto sector, shifted gears, slashing production levels as they sought to social distance their line employees.

As a real estate investment firm focused on owning and operating apartment communities, we needed to understand how these unprecedented disruptions to our health, mobility, and the general economy could impact our business, including our residents’ ability to earn a living and pay their rent.

With massive uncertainty around the extent of the pandemic’s impact on various regions and specific industry sectors, we began to study the resiliency of our markets. Our initial thesis was that Pathfinder’s markets would be more resilient in the face of the health/economic crisis than other markets due to the predominance of industries capable of adapting to new modes of operation (work from home) or by virtue of their being a hub for essential services. For example, we believed San Diego was a more economically resilient market than Las Vegas due to the former’s high employment in sectors such as defense manufacturing, government, and high-technology jobs, as opposed to the latter’s dependence on gaming, entertainment, and travel.

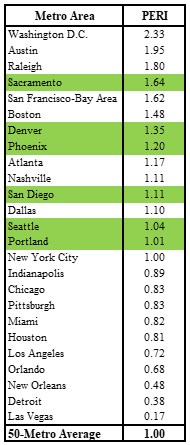

To examine our theory, we studied the distribution of industry sectors and employment growth in select metropolitan areas throughout the country. The objective of the PERITM was to measure and compare the economic resiliency of Pathfinder’s six western markets (Denver, Phoenix, Portland, Sacramento, San Diego, and Seattle) as compared with an index of 50 U.S. metro areas. The index was comprised of gateway cities (like New York City and San Francisco), high-growth areas (like Austin and Phoenix), entertainment hubs (like Orlando and Las Vegas), cities focused on traditional manufacturing (like Detroit and Chicago), and various centers of government employment (like Boston and Washington D.C) to measure the impact of government jobs. The index cities were chosen in part to provide geographic diversification.

To examine our theory, we studied the distribution of industry sectors and employment growth in select metropolitan areas throughout the country. The objective of the PERITM was to measure and compare the economic resiliency of Pathfinder’s six western markets (Denver, Phoenix, Portland, Sacramento, San Diego, and Seattle) as compared with an index of 50 U.S. metro areas. The index was comprised of gateway cities (like New York City and San Francisco), high-growth areas (like Austin and Phoenix), entertainment hubs (like Orlando and Las Vegas), cities focused on traditional manufacturing (like Detroit and Chicago), and various centers of government employment (like Boston and Washington D.C) to measure the impact of government jobs. The index cities were chosen in part to provide geographic diversification.

The index score for each market was determined by two components: 1) the 20-year average of employment growth (20% weighting) and 2) the concentration of employment in three industry sectors seen as resilient and non-resilient (80% weighting). We selected a longer 20-year time horizon to study employment growth since this period included robust growth, two recessions and unprecedented growth in the technology sector. A superior employment growth rate is a positive contribution to a metro area’s overall economic resilience while an inferior growth rate indicates potential weakness during tough times.

The three resilient sectors we selected were high technology, finance, and government/defense because of their workforce’s ability to work remotely and/or the essential nature of the services provided. The three non-resilient sectors were tourism, capital goods manufacturing, and energy/natural resources. We believed that as the U.S. entered a recession created by the pandemic, plummeting demand would disproportionately impact these sectors.

All models make assumptions and PERITM is no exception. The metro areas selected cover some, but not all, of the major population centers in the country. Also, the employment sectors included do not reflect the entire employment universe, and weighting used for each component of the index was determined based on our understanding that resiliency is determined as much or more by the nature of employment in a market than the long-term employment growth trend.

Economic resilience has perhaps never been more important than today for real estate investment. The risk spectrum has broadened and the last several years especially have been fraught with unpredictable risks, from public health to geopolitical unrest, which have impacted commercial real estate. The office and hospitality sectors are prime examples. No longer can investors overlook the concept of resilience and view it as an added feature versus a core requirement of property/market selection, portfolio diversification and investment management.

A market with consistent employment growth in sectors that can adapt quickly to disruptions, maintain continuous business operations, and protect principal is best positioned to survive an economic slowdown and ride out uncertainty. The markets that scored high in the PERITM have a distinct advantage when dealing with disruptions such as the pandemic or other crises because their economies have more embedded operational flexibility and/or provide essential public services. All of Pathfinder’s core markets ranked in the top half of the PERITM and several ranked in the top quartile.

Resilient markets directly benefit apartment owners because they maintain strong user demand (reflected in high occupancy) in times of economic disruption or market volatility. The essential need for housing means demand is steady throughout the economic cycle, including recessionary environments. That’s what we saw during the pandemic: residents were reluctant to move, they hunkered down in their apartments, which often doubled as offices and/or schools. We also experienced very strong collections during the pandemic, indicating that residents prioritized their housing over more discretionary items.

Regular and predictable income supported by strong market demand and high barriers to entry offer greater stability compared with other asset classes. Despite the pandemic-driven economic uncertainty, apartment rents and occupancy levels have generally increased while other asset classes, such as retail or office, have suffered.

Naturally, the concept of resilience extends beyond real estate. Over the last few years, business leaders have been reminded repeatedly of the interconnectedness and unpredictability of businesses, economies, and societies. Businesses benefit greatly when developing resilience in their workforce, products or services, and infrastructure. Resilience reduces the immediate impact of crises by enabling companies to anticipate, prepare for, and cushion against shocks. In addition, resilience also enables companies to respond to a crisis in opportunistic ways and shape the competitive environment to their advantage.

Naturally, the concept of resilience extends beyond real estate. Over the last few years, business leaders have been reminded repeatedly of the interconnectedness and unpredictability of businesses, economies, and societies. Businesses benefit greatly when developing resilience in their workforce, products or services, and infrastructure. Resilience reduces the immediate impact of crises by enabling companies to anticipate, prepare for, and cushion against shocks. In addition, resilience also enables companies to respond to a crisis in opportunistic ways and shape the competitive environment to their advantage.

Amazon is a good example of a business which adapted to and capitalized on opportunities that arose from pandemic-related disruptions. While other businesses were struggling to keep up with online demand, Amazon quickly adapted their operations by hiring additional staff, diversifying supply chains, increasing inventory levels, and implementing contactless delivery. Amazon saw their market share and profitability surge during the pandemic. In 2020, The New York Times reported that Amazon’s revenues grew 37% from 2019 with profits rising nearly 200%.

For Pathfinder, the PERITM serves as a risk management tool to monitor the economic resilience of markets over time, giving us the ability to make informed decisions and proactively pivot should conditions change. However, this concept applies to all businesses, which should continue evaluating resilience even as crises fade. Resilience does not just mean simply maintaining short-term, operational continuity. True resilience is more expansive and can be a driver of value. It requires focus on financials, operations, technology, and organization. A company’s capacity to absorb stress, recover critical functionality, and thrive in new circumstances will set it apart from its competitors over the long term.

Characteristics of resilience inherent in successful businesses include the ability to identify and assess a threat or risk, strong leadership, flexible processes that can be quickly adapted, and a focus on customer experience and retention. The risks of not adequately developing business resilience are financial loss, threats to business continuity, damaged reputations, and a slow recovery. As we have learned from the events of the last few years, prepared businesses were able to dynamically respond to adverse events in the market, enabling them to flourish in a challenging environment.

Brent Stuhley is the Acquisitions Director of Pathfinder Partners, which he joined in 2015. He previously served as an executive for a real estate investment company and a commercial real estate lender for several community banks. Brent can be reached at bstuhley@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER PARTNERS INCOME FUND, L.P.

A Stablized Multifamily Fund

CHARTING THE COURSE

Is This an Economic Pivot Point?

FINDING YOUR PATH

What Goes Up, Must Come Down (To Earth)

GUEST FEATURE

An Article about Nothing

GUEST FEATURE

Resiliency: An Important Driver of Value for Businesses and Investors

ZEITGEIST

News Highlights

TRAILBLAZING

Hiawatha, Seattle, WA

NOTABLES AND QUOTABLES

Integrity