An experienced firm with a focused approach

Pathfinder’s experience, track record, reputation and relationships – combined with a differentiated, “below-the-radar” investment strategy – position the firm as a leading middle market real estate fund manager.

Pathfinder has acquired 7,000+ multifamily units, with estimated invested capital exceeding $1 billion.

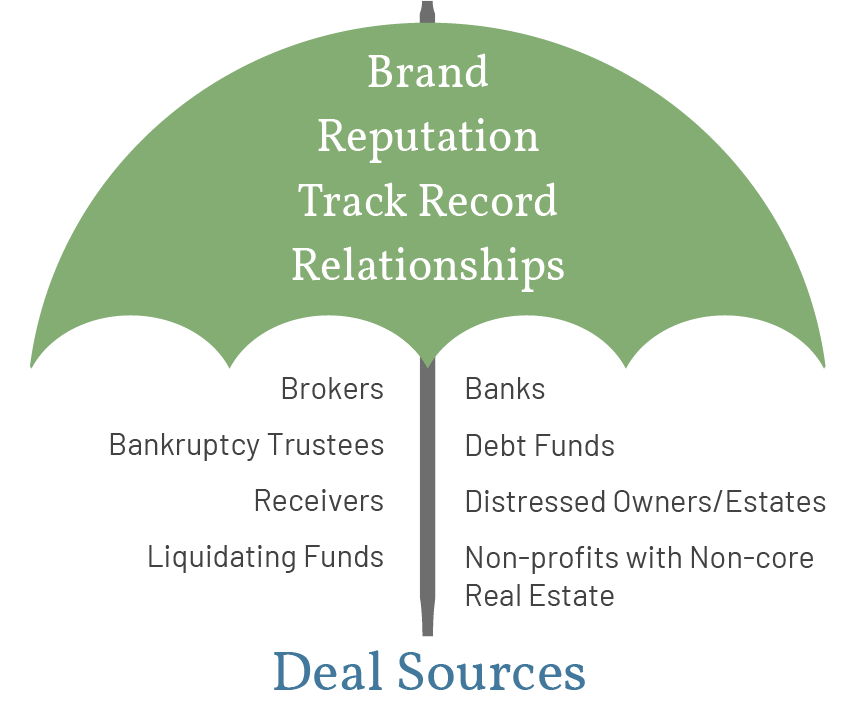

Our outstanding brand/reputation, deep relationships and strong prior fund portfolio drive robust deal flow pipeline.

The Pathfinder Advantage

Our Team of Experts

Founded in 2006, we were an early entrant in the distressed real estate investment space. Our team has broad-based experience in acquisitions, due diligence, fund management, legal and foreclosure strategies, restructurings and final analysis. Meet our team.

Accountability & Transparency

Pathfinder believes in a culture of open communication, honesty and transparency. Our communications with investors are best-in-class and our funds are audited annually and valued quarterly. Our compensation is linked to performance of funds and we are heavily invested side by side with our investors. If our investors do well, we do well.

A Focused Approach

Pathfinder builds diversified portfolios and targets superior risk-adjusted returns. We maximize fund returns by maximizing the value of properties and through disciplined and prudent use of debt leverage. Read more about what we do.

Industry Relationships

Our relationships with investors, business partners, sellers and brokers are very important. An outstanding reputation and deep relationships drive a robust deal flow pipeline. This allows Pathfinder to find "below the radar" properties in resilient markets. View our deal sources.

A Track Record of Excellence*

Pathfinder operates in a straightforward and transparent manner and seeks long-term relationships with others who share our core values. We have a long-term track record of generating superior returns for our investors.

12 Funds Sponsored

138 Properties Acquired

110 Dispositions

*as of January 2024

Pathfinder Deal Flow Pipeline

Subscribe to the Pathfinder Report

Read our engaging editorial content about real estate trends, investments & the economy.

© 2024 Pathfinder Partners. All Rights Reserved.