Guest Feature

The 2021 Apartment Market and What’s Ahead in 2022

By Scot Eisendrath, Managing Director

What a time it is to be in the multifamily industry. Whether you are an investor, developer, broker, mortgage banker, contractor, property manager or any of the various other players, it’s been extraordinary to watch the industry exit the pandemic firing on all cylinders.

Let’s look back at 2021’s property investment market with a focus on apartments. According to Real Capital Analytics, total commercial property sales reached a record $809 billion in 2021, one-third higher than the previous record of $600 billion in 2019, and close to double 2020’s volume during a pandemic.

Apartments were the darling of the property sectors, ringing up $335 billion in sales in 2021, up 128% over 2020, and close to double 2019’s previous record of $193 billion. (Industrial buildings, another red-hot property sector, came in a distant second with $166 billion in sales in 2021).

Last year, lenders lined up to provide borrowers debt to fund the robust sales and refinance activity. According to the Mortgage Bankers Association, there was $900 billion of commercial and multifamily mortgage lending in 2021, including record multifamily lending of $470 billion, a 54% increase over 2020 levels.

Last year, lenders lined up to provide borrowers debt to fund the robust sales and refinance activity. According to the Mortgage Bankers Association, there was $900 billion of commercial and multifamily mortgage lending in 2021, including record multifamily lending of $470 billion, a 54% increase over 2020 levels.

The surge in activity, especially in the multifamily sector, is due to several factors, including low interest rates, red-hot operating fundamentals (discussed below), lifestyle changes brought on by the pandemic and an abundance of capital (on both the debt and equity side) searching for yield with few viable alternatives.

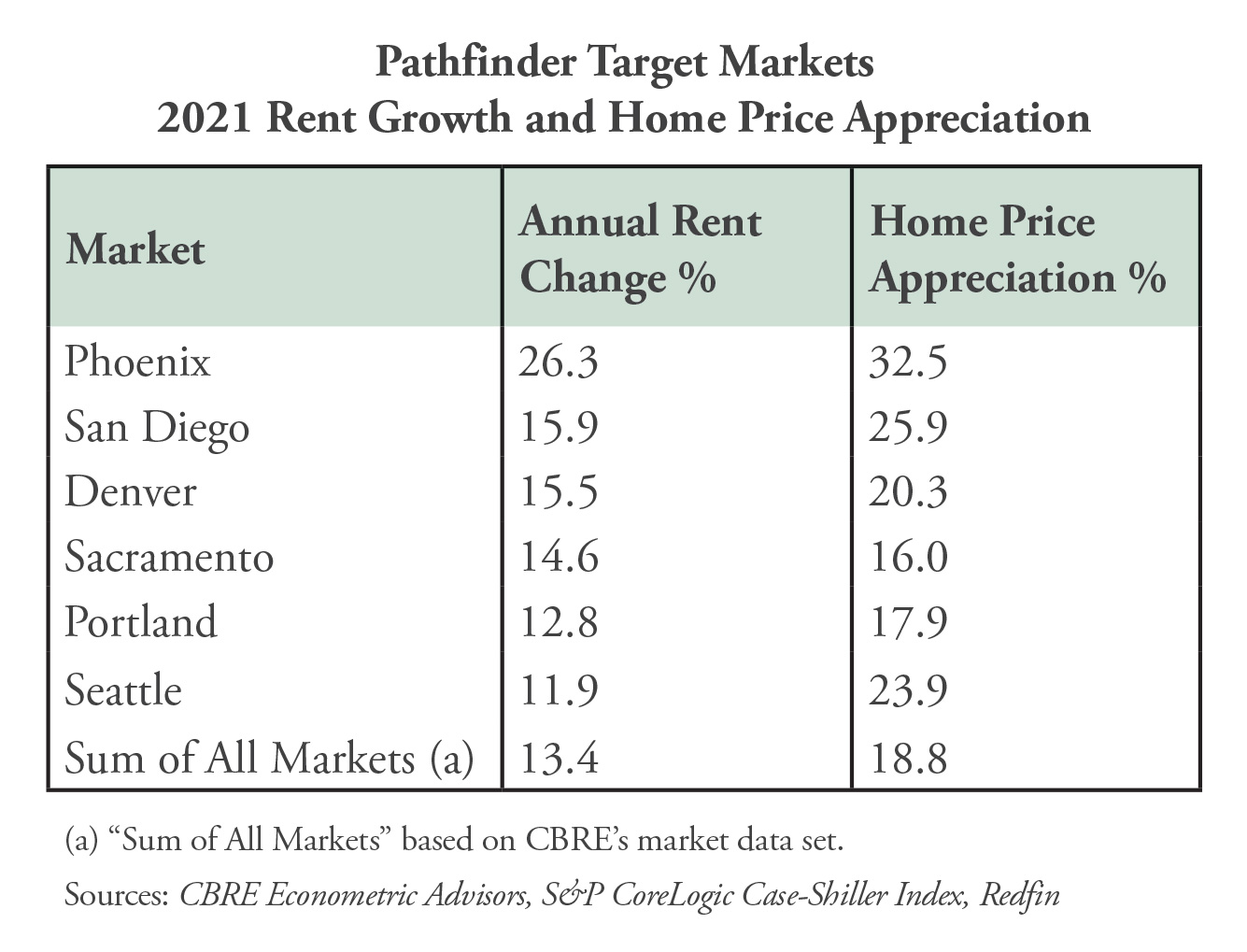

Demand for apartments has been sizzling. Strong tenant demand has led to a very tight apartment market as evidenced by decreasing vacancy rates, diminishing concessions and rapid rent growth. According to CBRE, there were 618,000 net apartment units absorbed last year, while only 275,000 units were completed, resulting in the vacancy rate plummeting from 4.7% to 2.5%. (A 5.0% vacancy rate has traditionally been considered a balanced market.) The supply/demand imbalance in the apartment market led to net effective rental rates increasing 13.4% from 2020 to 2021.

The supply/demand imbalance in Pathfinder’s western U.S. markets is even more acute and, as shown in the chart below, rents (and home prices) grew even faster than the national average.

From a renter’s perspective, the news isn’t all bad. While rents increased in 2021 at a brisk pace after a flat 2020, tenants can take solace in the fact that rents are not increasing at the same pace as home prices are appreciating, not to mention the additional costs of homeownership due to rising interest rates. So, comparatively, renting still is the affordable alternative to owning for many people and in many markets.

From a renter’s perspective, the news isn’t all bad. While rents increased in 2021 at a brisk pace after a flat 2020, tenants can take solace in the fact that rents are not increasing at the same pace as home prices are appreciating, not to mention the additional costs of homeownership due to rising interest rates. So, comparatively, renting still is the affordable alternative to owning for many people and in many markets.

Additionally, there continues to be innovation in the multifamily industry that benefits tenants. In many apartment complexes, landlords are adding smart amenities, including smart thermostats, locks and lighting, providing residents with updated features in their homes. Over the last couple of years, as tenants yearn for additional space, build-to-rent communities have gotten significant traction where residents are given the option to rent a professionally managed single-family home in a desirable suburban submarket without the need to qualify for a mortgage or provide a down payment, and without the upkeep and maintenance headaches of homeownership – as easy as renting an apartment. The apartment market continues to evolve to cater to customers’ preferences.

So, what’s in store this year? Many real estate investors believe that the multifamily investment market will not change much in 2022 as most of the factors noted above are expected to remain constant. Of course, interest rates, which are still near historical lows, will rise. As we deal with inflation, supply chain issues, geopolitical risks and rising interest rates, it’s important to reflect on why housing has historically been such a good place to invest, and why it should continue to be so in the future: we have a severe shortage of housing in the U.S., and that won’t change anytime soon.

Scot Eisendrath is Managing Director of Pathfinder Partners. He is actively involved with the firm’s financial analysis and underwriting and has spent more than 20 years in the commercial real estate industry with leading firms. He can be reached at seisendrath@pathfinderfunds.com

Share this Article

IN THIS ISSUE

PATHFINDER PARTNERS INCOME FUND, L.P.

A Stablized Multifamily Fund

CHARTING THE COURSE

Clean-Up on Aisle Five! Will the Fed Cause a Recession to Curb Inflation?

FINDING YOUR PATH

The Tipping Point in Home Prices?

GUEST FEATURE

The 2021 Apartment Market and What’s Ahead in 2022

ZEITGEIST

Sign of the Times

TRAILBLAZING

Chestnut Ridge, Denver, CO

NOTABLES AND QUOTABLES

Creativity