Finding Your Path

A Looming Crisis in the Banking Sector?

By Lorne Polger, Senior Managing Director

A potential crisis in pockets of the banking sector related to commercial real estate loans is emerging. This could have profound impacts and create interesting investment opportunities for the next few years. Several factors are at play.

Overvaluation of Properties that Comprise Collateral for Bank Loans

Commercial real estate was overvalued from 2021 through 2023 due to speculative bubbles and unrealistic expectations caused in part by the ultra-low interest rate environment. As Pathfinder has been saying since our founding back in 2006, trees just don’t grow to the sky. Many investors (and their lenders) placed speculative bets on continued short-term appreciation and oversized rent growth (across all sectors of commercial real estate). It worked until it didn’t.

Many of those acquisitions were financed with shorter-term debt, which is coming due. As interest rates rose and rents stagnated, capitalization rates (the benchmark behind real estate valuations) began to rise behind them, resulting in lowered values. And then on top of that, the hard-hit sectors, like office, got hit harder, as vacancies, particularly in central business districts, rose to near unprecedented levels. As the market continues to correct, lenders holding these loans may have to start taking losses from mark-to-market rules, loan covenant and monetary default violations, loss reserves, short sales or in some cases, foreclosures.

As recently reported in Globe St., quoting from the Fed’s January 2024 meeting: “Vulnerabilities in the financial sector remain notable, as losses in the fair value of long-dated bank assets remain significant.” Risk-based capital ratios are “well above regulatory minimums, driven both by robust bank profitability and by a decrease in shareholder payouts at the largest banks,” the article continued.

However, while “credit quality at banks remained strong,” the “quality of CRE loans backed by office, retail, and multifamily buildings continued its decline.” And it’s not just remote work that is causing the problem. The Fed noted that “Commercial real estate (CRE) prices continued to decline, especially in the office, retail, and multifamily sectors, and low levels of transactions in the office sector likely indicated that prices had not yet fully reflected the sector’s weaker fundamental…Some smaller regional and community banks with high concentrations of CRE loans are also highly reliant on uninsured deposits, potentially compounding vulnerabilities.”

However, while “credit quality at banks remained strong,” the “quality of CRE loans backed by office, retail, and multifamily buildings continued its decline.” And it’s not just remote work that is causing the problem. The Fed noted that “Commercial real estate (CRE) prices continued to decline, especially in the office, retail, and multifamily sectors, and low levels of transactions in the office sector likely indicated that prices had not yet fully reflected the sector’s weaker fundamental…Some smaller regional and community banks with high concentrations of CRE loans are also highly reliant on uninsured deposits, potentially compounding vulnerabilities.”

Translation: When portfolios of loans are based on properties with falling valuations, the values of the loans are reduced, opening the potential for an inability to refinance, and further pushing on how long banks can carry loans at full value on their balance sheets.

During Treasury Secretary Janet Yellen’s remarks to the Senate banking committee in February, she noted that valuations are falling, and that stress and losses will be forthcoming. Yellen stated: “I hope and believe that this will not end up being a systemic risk to the banking system. The exposure of the largest banks is quite low, but there may be smaller banks that are stressed by these developments.”

According to a recent report from the banking industry consulting firm, Klaros Group, nearly 300 banks with heavy CRE exposure could need a capital infusion or require a merger with another institution to avoid failure. CNBC reported that the study found that 282 banks with $900 billion in total assets have real estate loans that make up more than 300% of their capital and have a high proportion of unrealized losses on low-interest loans made before the Fed started its aggressive rate-hiking campaign.

Commercial Property Debt Concentrated in Small Banks

Most banks at risk are community banks with less than $10 billion in assets, Klaros found. Of the 4,000 banks the firm analyzed, more than 7% were deemed as under stress. That becomes a bit of a tightrope walk for regulators who do not want to see another repeat of the 2023 bank failures that were caused by embedded losses in securities investments.

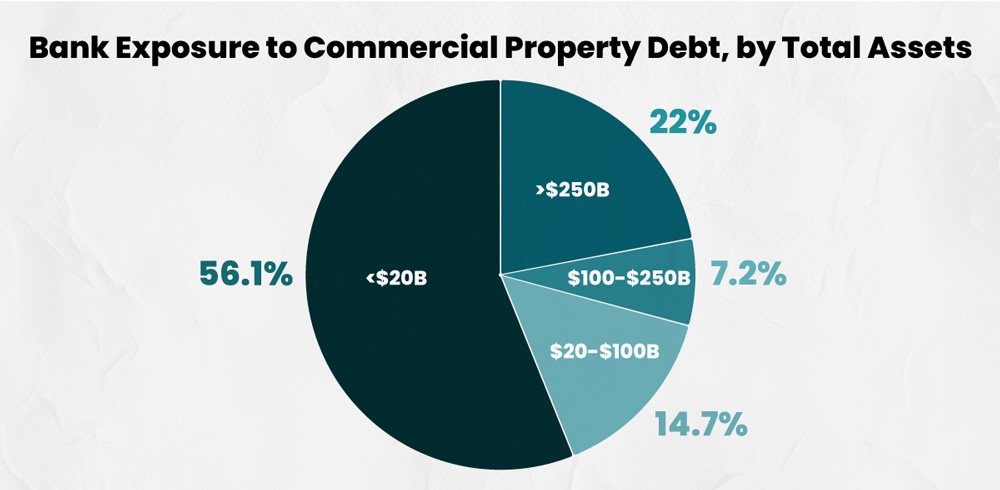

Banks with assets below $20 billion hold 56% of the commercial real estate property loans in the U.S. (See chart below courtesy of Visualcapitalist.com)

If credit losses accelerate and CRE valuations continue to decline, those banks run a higher risk of failure. Most certainly, they will be more closely scrutinized by the regulators. Community

banks are more susceptible to taking hits from write-downs. Now not all smaller banks are heavy on exposure to the riskier classes of real estate. But some went overweight in the sector while the markets were heating up; those banks have the most exposure today.

Embedded Losses

Embedded bank losses, through unrealized securities and loan mark-to-market losses, stood at $700 billion at the end of 2023. If long-term treasury yields don’t fall (or gulp, rise again!), we may see greater pressure on banks to mark their investment portfolios to market and take that hit now.

Upcoming Wave of Loan Maturities

Adding to the woes – nearly $1 trillion of commercial real estate loans are expected to mature in 2024 alone, according to the Mortgage Bankers Association, of which $441 billion is held by banks. About 20% may be in the most vulnerable category (office). So, here’s the scenario. Bank made a loan on an office building in 2021. The building was worth $30 million at the time and the bank made a conservative loan of $20 million. Today, the building is 60% occupied and worth $20 million on a good day. Most banks would loan about 50% on that deal today, call it $10 million. Who makes up the shortfall? Does the bank extend the current loan at 100% loan-to-value? Likely not. Perhaps, for a good customer, they will ask for a significant paydown for a year to give the borrower some hope for the future. But they won’t do that forever. And if the borrower sees that the ship is sinking, some will just toss the keys back. Not pretty.

Persistent Inflation

Banks continue to hope that the Fed will begin cutting interest rates this summer, which could ease pressure on struggling banks. That said, earlier predictions of four to six cuts in 2024 have been reduced to predictions of only three, as hotter-than-expected inflation to start 2024 has tempered the enthusiasm for reductions.

The banking sector is a bit of a lagging indicator. Following the global financial crisis, credit losses peaked two years after delinquencies did. Clearly there is still pain to come, even if the Fed begins moderating rates later this year.

Sector-Specific Challenges

Certain sectors within commercial real estate, specifically office, are facing unique challenges due to changes in work behavior and technological disruptions. As office occupancy continues to dip (downtown markets appear most susceptible; two markets that we regularly track, San Diego and Denver, are showing downtown office vacancy rates at historically high levels, over 30%), office loans are at higher risk of default.

Certain sectors within commercial real estate, specifically office, are facing unique challenges due to changes in work behavior and technological disruptions. As office occupancy continues to dip (downtown markets appear most susceptible; two markets that we regularly track, San Diego and Denver, are showing downtown office vacancy rates at historically high levels, over 30%), office loans are at higher risk of default.

By example, Denver currently has eleven office buildings in some form of receivership or foreclosure. We believe that the number will increase, and we expect to see the same trend line across many markets. For those lenders with heavier exposure to office, those loans could result in significant hits to capital. You can only kick the can so far down the road…

Bank Regulator Requirements

At some point, bank regulators will require banks to mark down some of those loan portfolios in ways similar to the required mark downs of investment portfolios. Our belief is that is when the pain will come. Those appraisals tucked in the files from 2022? Pretty worthless these days. When true values are updated and debt coverage tests are conducted, we will then begin to see some of the wheat separating from the chaff. And it’s not going to be pretty.

Opportunities

Notwithstanding the headwinds, we see opportunities both within the banking sector and for real estate investors.

Within the sector, we think there will be new lending opportunities for those banks that are not currently overweight in CRE loans. Those banks will seek opportunities from well capitalized borrowers who may be able to opportunistically purchase properties and loans at significant discounts to peak pricing. For the buyers, it’s all about a reset in basis. For example, if an asset that previously traded at $500/square foot is repriced to $200/square foot following a short sale or foreclosure, and the new lender can now lend 60% of that value, that lender can likely feel confident about that value/loan basis, especially as it compares to the replacement cost of the property.

On the investment side, we believe that the acceleration of problems in loan portfolios will lead to interesting investment opportunities at attractive prices across the CRE sector. Perhaps not the scope of opportunities that we saw during the Great Financial Crisis, but we don’t believe that the days of “extend and pretend” will be with us during the current period of heightened regulatory scrutiny.

Lorne Polger is Senior Managing Director of Pathfinder Partners. Prior to co-founding Pathfinder in 2006, Lorne was a partner with a leading San Diego law firm, where he headed the Real Estate, Land Use and Environmental Law group. He can be reached at lpolger@pathfinderfunds.com.

Share this Article

IN THIS ISSUE

PATHFINDER PARTNERS INCOME FUND, L.P.

A Stablized Multifamily Fund

CHARTING THE COURSE

Perception of Inflation – Falling or Still Too High? – Will Tell the Tale in November

FINDING YOUR PATH

A Looming Crisis in the Banking Sector?

GUEST FEATURE

The Impact of AI on Apartment Investing

ZEITGEIST

News Highlights

TRAILBLAZING

Point Loma Palms, Point Loma (San Diego), CA

NOTABLES AND QUOTABLES

Disruption / Innovation