Charting the Course

Change at the Speed of Light

By Mitch Siegler, Senior Managing Director

In any story there is that which is seen and that which is hidden – like an iceberg. In the economic story of 2022, seven themes are apparent: Supply chain challenges, high gas prices, high inflation, rising interest rates, economic slowdown, deflating asset values and Russia’s invasion of Ukraine. Each of these headlines is distinct and the subject of hundreds of news stories. Yet, they’re all wrapped up together and each story is unfolding at breakneck speed.

Supply Chain and Labor Challenges – Headlines focus on hundreds of container ships waiting to be unloaded off the ports of Los Angeles and Long Beach or loaded in the Chinese ports of Shanghai and Shenzen. Other stories tell the tale of curtailed wheat shipments from Ukraine leading to famine in Africa or semiconductor shortages from Taiwan leading to delays (and higher prices for) autos, iPhones and computers. Peel back the onion and the common story these is labor shortages. The root cause of backlogs in Chinese ports is China’s zero-Covid policy, ergo, not enough workers. The challenges at southern California ports is attributed to a truck driver shortage, labor challenges at the ports or both. Parts and material shortages have lengthened lead times and driven up prices for washing machines, outdoor furniture, doors and windows, paint – you name it. For those who think labor shortages will soon be a thing of the past or wage inflation is slowing, consider recent moves to unionize at Starbuck’s and Amazon. It’s hard to tell the supply chain/labor story without also touching on the inflation story.

High Gas Prices – It’s not just higher gas prices – now above $5.00/gallon nationwide and approaching $7.00/gallon in California – and poised to rise further this summer. Steel yourself for higher (perhaps much higher) electricity charges this winter. Absolutely, let’s blame Putin for $1.49/gallon moves since his brutal invasion of Ukraine (gas prices were $3.62/gallon on Feb. 21, before the invasion and average $5.11/gallon on June 30.) But truth be told, gas prices began their rise more than a year before. Gas prices rose $.79/gallon or 34% in the first half of 2021 (from $2.33/gallon last January to $3.12 last June) and another $.50/gallon prior to the onset of the war. Quick math: gas prices have more than doubled in 18 months and more than half of that rise occurred before the first Russian shot had been fired. There are lots of reasons for that, including lower U.S. oil production and refining but you can’t tell the gas price story without also telling the inflation story. That again.

High Gas Prices – It’s not just higher gas prices – now above $5.00/gallon nationwide and approaching $7.00/gallon in California – and poised to rise further this summer. Steel yourself for higher (perhaps much higher) electricity charges this winter. Absolutely, let’s blame Putin for $1.49/gallon moves since his brutal invasion of Ukraine (gas prices were $3.62/gallon on Feb. 21, before the invasion and average $5.11/gallon on June 30.) But truth be told, gas prices began their rise more than a year before. Gas prices rose $.79/gallon or 34% in the first half of 2021 (from $2.33/gallon last January to $3.12 last June) and another $.50/gallon prior to the onset of the war. Quick math: gas prices have more than doubled in 18 months and more than half of that rise occurred before the first Russian shot had been fired. There are lots of reasons for that, including lower U.S. oil production and refining but you can’t tell the gas price story without also telling the inflation story. That again.

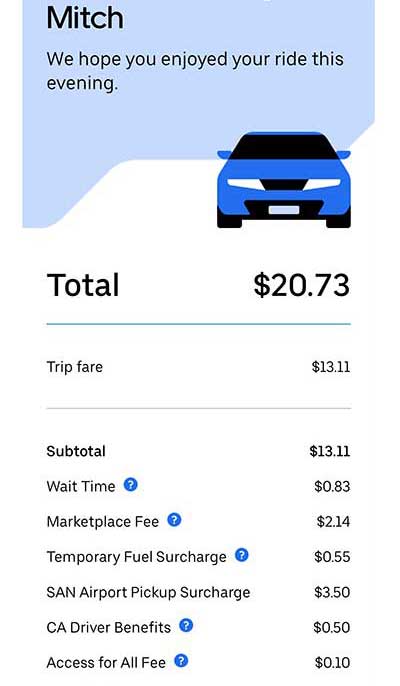

High Inflation – Inflation bites when it hits people frequently and everywhere they turn. When prices for bread, eggs, milk and gasoline rise so much that it’s obvious to everyone, that’s inflation. When Kellogg’s and Heinz maintain prices and shrink the contents of cereal boxes and ketchup bottles, that’s inflation – hidden, beneath the surface. When home prices skyrocket and rents rise at unusually high levels, that’s inflation. When WalMart, Target and Amazon bump wages by $2-$3/hour just so they can hire and retain staff, that’s wage inflation. When restaurants can’t hire enough cooks, busboys or wait staff or hotels can’t hire enough housekeeping staff – even with large wage increases – that’s inflation married to a labor shortage. Add in rising mortgage rates and credit card interest rates and sprinkle in hidden fees (our recent restaurant bills included kitchen appreciation fees, wellness fees and supply chain surcharges; recent Uber fares had temporary fuel surcharges, driver benefits and marketplace fees – whatever the heck those are!). Higher prices, smaller package sizes and hidden fees – now, that’s inflation!

Rising Interest Rates – The Federal Reserve, which arrived a bit late to the party, has been moving aggressively since March to “take away the punchbowl.” Diane Swonk, chief economist at Grant Thornton, LLP said it well: “The Fed’s goal is for inflation not to become entrenched… It will be that much harder to derail later. You can’t make the mistake of the 1970s. You must… bring demand down in a supply-constrained world, as painful as that may be.” The Fed Funds rate is now 150 basis points higher than in March following three rate bumps of 25, 50 and 75 basis points. (A basis point is 1/100 of a percent.) Inflation has been building for more than a year and many economists and analysts have been critical of the Fed for its sloth-like moves at the start. But it’s moved fast this year! As the Fed moves aggressively to catch-up and cool off inflation, it’s becoming clear to many that the Fed’s tools, which will certainly squelch demand, have questionable utility impacting supply chain challenges, labor shortages or the world oil market.

Economic Slowdown – Since unemployment peaked at 14.7% when the pandemic shut-down our economy in March 2020, job growth has been brisk and unemployment has trended steadily lower, hovering below 4% all year. The housing market, like the equity market, is often one of the first shoes to drop when the Fed begins tightening. New mortgage applications recently hit a 22-year low and leading publicly traded homebuilder stocks are trading at just 3-4 times forward earnings. Everybody’s hoping for an economic “soft landing” (an economic slowdown that doesn’t precipitate a recession) though warning signs abound and if we avoid a recession, it’s likely to be by a whisker. The trillion-dollar question: Can the Fed slow demand so it catches up with tight supply relatively quickly? And can they do so and bring about the elusive soft landing? Spoiler alert: of the Fed’s previous 12 major tightening cycles since the 1950s, nine ended with recessions, per the Wall Street Journal. In a late June survey of economists, Goldman Sachs, JP Morgan Chase, Citicorp and Bank of America pegged the odds of a recession at 35%-50%. These predictions were nowhere to be seen just a few months ago.

Deflating Asset Values – Storm clouds began appearing last year as inflation took hold and speculative activity – like SPAC’s and cryptocurrency – were among the first sectors to catch cold. Following soon behind were overpriced technology stocks, which fell hard, with many leading tech stocks down 50% or more. Those moves – investors essentially rotating out of crap into quality – precipitated a general decline in the stock market with both the technology-heavy NASDAQ and the broader S&P 500 index swooning more than 20% this year, plunging both into bear market territory. In the past few weeks, scads of retailers, including Wal Mart and Target, have reported excess inventories – another way of saying sales aren’t where they’d like them to be. Their stocks have taken a beating, too with WMT 24% off its 52-week high and TGT down 45%. And it happened fast!

Russia’s Invasion of Ukraine – Russia’s invasion of Ukraine is downright awful on its face, but the bigger picture is that it may lead to the dawn of a new geopolitical order with a reinvigorated NATO, a need to boost U.S. defense spending and a renewed recognition of the geopolitical threat from China. Each of these has massive, long-term economic implications. In the short term, the invasion is greatly impacting commodity prices, particularly for oil, wheat and fertilizer. Goldman Sachs’ Commodity Index (GSCI) has risen 38% since the start of the year.

Russia’s Invasion of Ukraine – Russia’s invasion of Ukraine is downright awful on its face, but the bigger picture is that it may lead to the dawn of a new geopolitical order with a reinvigorated NATO, a need to boost U.S. defense spending and a renewed recognition of the geopolitical threat from China. Each of these has massive, long-term economic implications. In the short term, the invasion is greatly impacting commodity prices, particularly for oil, wheat and fertilizer. Goldman Sachs’ Commodity Index (GSCI) has risen 38% since the start of the year.

What’s frustrating for many is the magnitude of these moves and the speed with which each has burst upon the scene. To make matters worse, many folks think pressures have been building in each of these areas for a while and policymakers who should have spotted the trends long ago and acted on them sooner simply weren’t on top of it.

We’re living in a fast-paced world where change happens in a big way and lightening fast. Since there’s not a whole lot any of us can do about that, relax a bit and enjoy your summer.

Mitch Siegler is Senior Managing Director of Pathfinder Partners. Prior to co-founding Pathfinder in 2006, Mitch founded and served as CEO of several companies and was a partner with an investment banking and venture capital firm. He can be reached at msiegler@pathfinderfunds.com.

Share this Article